During the last 20 years of rapid growth, more and more franchisors, both Western and local, have entered the Chinese market. Back in the early 1990s, there was no exact definition for the word “franchise” and the PRC government did not formally regulate the procedures of franchising. Nowadays, however, the favorable laws and the world’s biggest middle class attract more brands than ever. Positive growth is witnessed in sectors such as food service, hotels, retailing, etc.

Franchising is a common practice by which a company (or franchisor) is granting another entrepreneur (or franchisee) the right to use the franchisors business brand for a fixed period of time. In order to gain access to this privilege and also other services provided by the franchisor, such as national or international advertising, training and advisory assistance, the franchisee has to make several payments to the franchisor, such as royalties for trademark usage, reimbursements for the services provided by franchisor, and a certain percentage of the franchisee’s profit. Nowadays franchising is also known as one of the ways to enter a foreign market and is proven to be a successful strategy for expanding a company and distributing its services or goods.

However, there are various difficulties when moving into the Chinese market, such as the new operating environment and various economic, political and cultural differences. Franchising is still quite new in China as the Interim Measures on Regulating Commercial Franchise Operations were issued only in 1997! However, China ascension to the WTO and the rapid economic development made these measures obsolete, since they did not really address foreign companies.

Therefore, new regulations were introduced in 2004, which aimed at bringing the previous rules in line with WTO standards. In 2007, the regulations were further refined.

In addition, due to the positive modifications in Franchise Regulations issued in 2007, franchising process became more liberal and favorable for foreign investors and have requirements less severe compared to Franchise Measures of 2004.

Types of Franchises

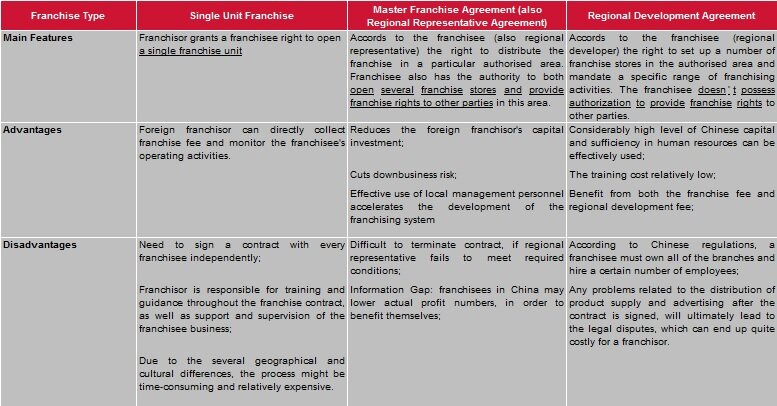

There are three types of franchises, foreign companies can set up in China:

- Single Unit Franchise

- Master Franchise Agreement or Regional Representative Agreement

- Regional Development Agreement

How to set up a Master Franchise Agreement

Generally, there are two methods of setting up master franchise agreement in China:

- Handing over franchise rights directly to the Chinese franchisee, which implies choosing one or more regional representatives and granting them franchising rights to open stores and distribute the franchise to third parties.

- Establishing of foreign invested enterprises – franchisor can choose to set up WFOE, Sino-foreign joint-venture or contractual joint venture. Due to the appliance of foreign franchisor’s resources in setting up an entity, it can positively impact the business development of the franchise.

Main Regulations in China

In order to satisfy Franchise Regulations in China the companies should meet several conditions such as:

One of the main regulations is the so-called “Two-Plus-One Rule”. It demands that a franchisor must first have two company-owned entities either in its home country or in China for at least for one year, before being able to sell franchise rights in China.

1. Information about the commercial franchise;

2. Distribution information of franchised stores in China;

3. Franchisor’s Commercial Prospectus;

4. Copy of business license or enterprise registration;

5. Copies of certificates of trademarks, patents and other business resources related to franchise activities;

6. Sample franchise agreement;

7. Franchise operational manuals;

8. Written undertaking evidencing franchisors complies with the Qualifications and the Two-Plus-One Rule;

9. Marketing plan;

10. Certificate evidencing compliance with the Two-Plus-One rule, issued by the city level in China and, for franchisors using space outside of China, business certificates translated, notarized and authenticated by the Chinese embassy;

11. Other documents if required.

Even though franchising in China may seem difficult there are also exceptional opportunities. Following the expansion of the middle- and upper-class consumer base, the range of products Chinese customers can afford also broadened. This has created new perspectives for foreign brands, especially Western ones, since Chinese customers often associate them with high quality and better customer service.

However, since wages and rents have started to rise in first-tier cities (Beijing, Shanghai, Shenzhen, Guangzhou), lower labor and real estate costs in second-tier and third-tier cities should be taken into consideration by “new-comers”.

Even though there are certain challenges of coming into China’s market, the opportunities and perspectives shouldn’t be underestimated as it encourages good business development and production, growth of salaries and further advancement of services.

Continue reading about similar topics such as How to set up a company in China or Company Setup Now Possible Without MOFCOM Approval.

You can also learn more about all relevant facts by heading over to our legal services info page.

|

Richard Hoffmann

Richard Hoffmann is a partner at ECOVIS Beijing China. Richard obtained an honors degree in law and worked in Germany, the United States, and China for various prestigious law firms prior to joining ECOVIS. In addition to being a member of the board of ECOVIS International, he is Supervisor for the China business of a respected German company and shares his extensive knowledge to students by teaching commercial law in China at SRH Hochschule Heidelberg. He has published more than fifty articles in international magazines, frequently speaks at high profile events in China and abroad and is often invited as a legal expert by international TV stations. Contact:

|

|

| Ecovis Beijing is the trusted tax and legal advisor to several embassies and official institutions in China. It specializes in mid-sized international companies and is focused on tax & legal advisory, accounting and auditing. If you’re interested in finding out more about tax and legal, don’t hesitate to sign up for our Newsletter, give us a call +86 (10) 6561 6609 or contact us directly via | ||